How AML Screening Works

Discover how our AML screening process helps your business stay compliant with global regulations while identifying and mitigating financial risks.

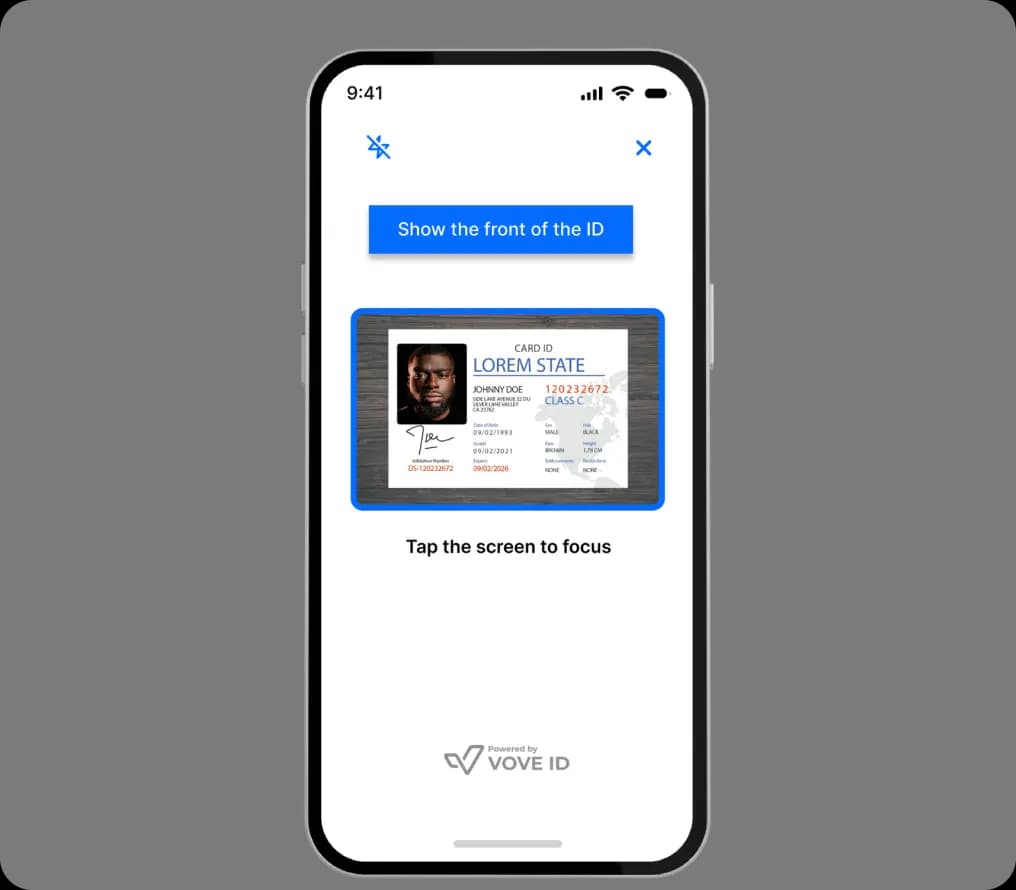

- 1

User’s identity is verified

Users upload a valid ID, and our system guides them in real time to ensure the photo meets quality standards.

- 2

Data is screened against global watchlists

After submitting the ID, user info is checked against global sanctions and watchlists for risks.

- 3

Risk signals and decisions are returned

When a match is found, the system flags it and assigns a risk score, providing insights to approve, review, or reject onboarding.

Engineered for Accuracy and Reliability

2100+

Documents supported

60 sec

Average verification time

190+

Supported Countries

The complete compliance toolbox in one place

Meet AML requirements faster. Centralize screening, reviews, and reporting in a single platform designed for compliance teams

Sanctions, PEPs, & Watchlist Coverage

Screen users against 1,000+ international watchlists, PEPs, and sanctions lists from over 200 countries, in real time.

Sanctions, PEPs, & Watchlist Coverage

Screen users against 1,000+ international watchlists, PEPs, and sanctions lists from over 200 countries, in real time.

Adverse Media Screening

Adverse Media, done right: 235,000+ globally curated sources, high-trust coverage, and clear signals to enrich customer risk profiles and flag issues early.

Adverse Media Screening

Adverse Media, done right: 235,000+ globally curated sources, high-trust coverage, and clear signals to enrich customer risk profiles and flag issues early.

AML monitoring, ready in minutes

Continuous AML surveillance with automated PEP, sanctions, and adverse media screening. Integration enables consistent RBA execution across your portfolio.

AML monitoring, ready in minutes

Continuous AML surveillance with automated PEP, sanctions, and adverse media screening. Integration enables consistent RBA execution across your portfolio.

Compliance

VOVE ID ensures robust security with 24/7 monitoring, strict controls, and a dedicated security team

Find the Right Fit for Your Needs

VOVE ID offers flexible and secure identity verification for any business, startup, enterprise, or government. Get speed, precision, and compliance without compromising user experience.

| VOVE ID | Persona | |

|---|---|---|

| Liveness first check | Passive + Active Liveness by default | 2D Only + Extra fees for 3D Liveness |

| Support Quality | Dedicated Slack/ WhatsApp + 24/7 | Limited, Paid |

| Integration speed | <5h to production | 1-2 days |

| Pricing Transparency | Pay-As-You-Grow / No Min Engagement | Enterprise plans + min engagement |

| Custom Branding | Full control |

| VOVE ID | Persona | Idenfy | Sumsub | |

|---|---|---|---|---|

| Liveness first check | Passive + Active Liveness by default | 2D Only + Extra fees for 3D Liveness | 2D Only + Extra fees for 3D Liveness | 2D Only + Extra fees for 3D Liveness |

| Support Quality | Dedicated Slack/ WhatsApp + 24/7 | Limited, Paid | Email/tickets | Email/tickets |

| Integration speed | <5h to production | 1-2 days | 1-2 days | 2-3 days |

| Pricing Transparency | Pay-As-You-Grow / No Min Engagement | Enterprise plans + min engagement | Enterprise plans + min engagement | Enterprise plans + min engagement |

| Custom Branding | Full control |